Economic harm is behaviour towards a person that controls, restricts or removes their access to money, economic resources or participation in financial decisions.

Economic harm, often called financial or economic abuse, is recognised as a form of psychological abuse within the Family Violence Act.

It is experienced in many close personal relationships, particularly intimate partner relationships. It may also include forms of elder abuse.

Economic Harm Explained

Economic Harm Explained

Economic harm is behaviour towards a person that controls, restricts or removes their access to money, economic resources or participation in financial decisions.

Economic harm, often called financial or economic abuse, is recognised as a form of psychological abuse within the Family Violence Act.

It is experienced in many close personal relationships, particularly intimate partner relationships. It may also include forms of elder abuse.

“It was like he had an image of a perfect girlfriend. He would decide what I wore, where I went, who I saw and give me as much money as he thought I needed for the things he agreed that I could do.”

Unlike physical violence, economic harm is less visible and does not leave marks; the impact can be debilitating, and can affect financial security well into the future.

In situations where demands are refused, what begins as economic abuse can lead to other forms of abuse such as yelling, threats and more violent behaviour.

Understanding economic harm

Economic harm can impact all ages, socio-economic groups, cultures, ethnicities and genders.

It may also present differently in some cultures due to traditions and beliefs, or the systemic experience of colonisation.

Economic harm is experienced in the context of power and control and is often intentional, but not always.

Like other forms of violence it can be subtle, beginning with the smallest breach of trust, and then build over time.

“I was afraid to get clothes for the kids”

Economic harm can also be a product of intergenerational learning, role modelling, previous trauma, belief systems, limited knowledge, traditions etc.

It is most evident when a specific pattern of behaviour is occurring – such as coercion, withholding financial access or support, deceptive behaviour or unreasonable control that limits another persons’ economic or financial involvement – including resources such as accommodation, transport, employment and clothing.

It may also involve limited or no participation in decisions or actions relating to financial and economic wellbeing.

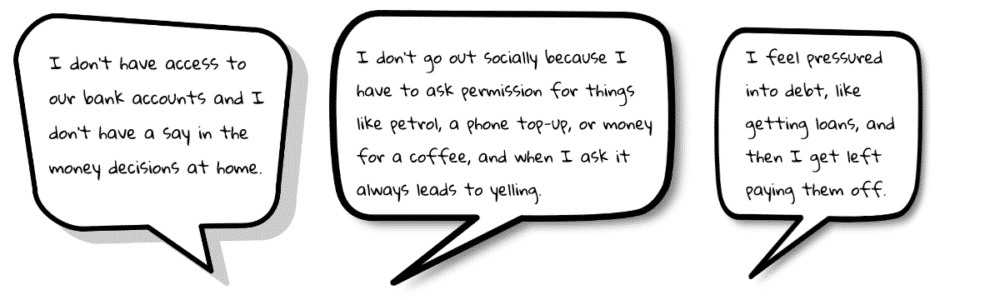

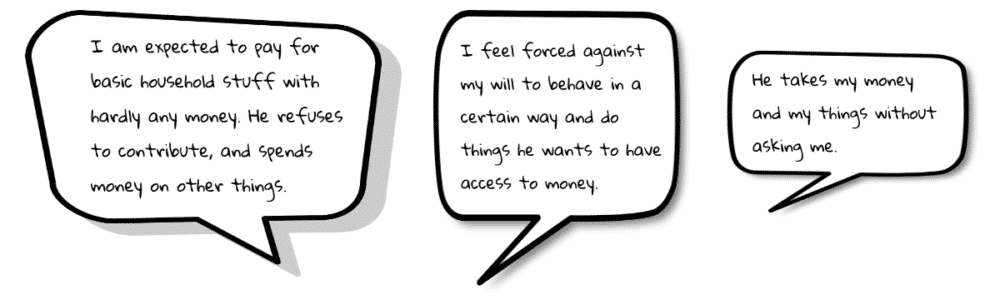

What does economic harm look like?

Other behaviour may be occuring, particularly if a person is trying to leave the relationship, which can be the most dangerous time.

This could be such things as:

Child support isn't being paid

The car is damaged so you can't go anywhere

Court process intentionally dragged out

Money or resources being withheld to prevent you from leaving the relationship

Your employment situation becomes difficult due to constant harassment

Human relationships are complex.

There are many things to navigate in a close personal relationship, and one of the most common challenges is money and finances.

Discussions about money will surface at some point and are not only necessary, but can be difficult regardless of how healthy a relationship is.

There is however, a difference between “money problems” that a couple works on together to resolve, and the financial controlling that can lead to economic harm.

Is it happening to me?

If your answer is yes to one or more of these questions below, you could be experiencing economic harm.

- Do you have to ask for money or explain your spending needs for everyday items or basic needs?

- Have you ever been coerced/forced to give up your job, go to work or stay home?

- Are you pressured to act in a specific way to have access to money?

If your answer is no to one or more of these questions below, you could be experiencing economic harm.

- Do you have access to the money in your personal and family bank account?

- Are you allowed to know how much debt your family has?

- Do you have some or equal decision-making power over how the household money is spent?

Other useful resources

Downloadable PDFs

Downloadable pdf versions of the information on this website.

Economic Abuse – how do I know it is happening?

Economic Abuse – what is the impact?

Resources

Research

Published by the Good Shepherd network in New Zealand and Australia –

Economic Abuse in New Zealand: Towards an understanding and response. (2018)

Other research

Did you find this useful?

We are a not-for-profit organisation working to improve the financial and social wellbeing of New Zealanders.

The resources on this website are provided free of charge to make sure they are available for people who need them.

If your organisation found these resources helpful, please consider making a donation to ensure we can continue supporting those people who need our help.

You can also make a donation, or set up a recurring donation, by contacting us directly