New budget: a chance to breathe

May 19, 2023

Clients will have more money left in their pockets and more time on their hands thanks to earlier access to ECE, discounted transport and waived prescription fees; all of which have been announced in the 2023 Government Wellbeing budget.

“Too many people across Aotearoa are facing financial hardship because there is simply not enough money left at the end of the week, which is why it is crucial to prioritise communities that are struggling so they can find their feet again and thrive.”

– Head of Microfinance, Natalie Vincent

60% of our clients on our Good Loans and DEBTsolve programmes have one or more dependents, and although they are usually great budgeters, they often do not have enough money at the end of the week to cover costs; or the time to bring in more money. It makes it harder for them to take back control of their unmanageable debt and thrive again in our communities. We are confident that these new changes will help ease the burden and free up more money for essential costs – improving financial wellbeing across Aotearoa.

We are also pleased to see the Government is continuing to support microfinance and debt solutions. The growing enquiries into our Good Loans and DEBTsolve programmes is evidence that whānau across the country are struggling to keep up with the cost of living and the burden of unmanageable debt. Continued investment into our microfinance services, as announced this week, will help us provide whānau across Aotearoa with better support and enable them take back control of their financial wellbeing.

“Our priority is to ensure people facing financial challenges continue to have safe, fair and affordable choices when it comes to credit and have the support they need.” Natalie said.

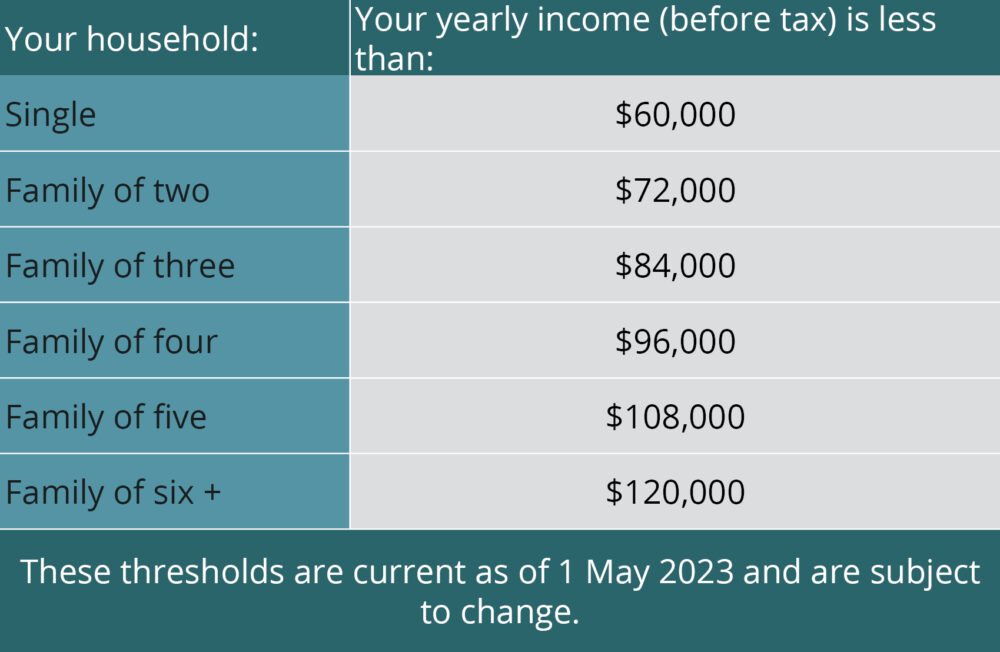

Increased income thresholds

To reduce the barriers and increase access to fair and

affordable lending for the growing number of people who need support, we worked

closely with our partner BNZ to change the eligibility criteria to give more

people the option to access our Good Loans and DEBTsolve programmes.

Our Good Loans programme offers no interest loans up to $7,000 to help people living on limited incomes access an essential item or service; without the risks of high-interest and unmanageable debt.

DEBTsolve supports people to take back control of their unmanageable debt through coaching, advocacy and a potential no interest Good Loan of up to $15,000

Natalie said:

“More people in our communities, that have been excluded from traditional finance products, now have another choice when it comes to credit. It is one that is fair and affordable, that is without the risks of unmanageable debt and high interest and has their long-term financial wellbeing at the centre – which I am confident will result in a better Aotearoa for all.”